When Should You Opt for an Adjustable Rate Mortgage?

Posted on Tuesday, February 21, 2017

Is an adjustable rate mortgage the right choice for you?

If you never likes the teeter-totter on the playground as a child, will you be comfortable with the uncertainty of an adjustable rate mortgage? It goes up and down, and you need to be comfortable with that.

That said, if you're buying a house, an adjustable rate mortgage could be a sensible choice. Here's why.

1. You Want Lower Fixed Rates

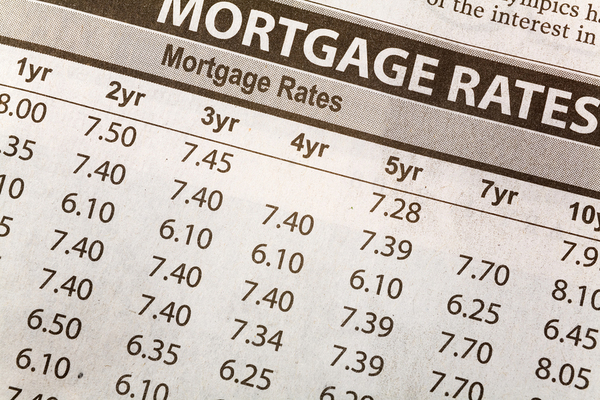

According to Quicken Loans, an ARM has a fixed period where the rate won't change, typically 3, 5 or 7 years. The rate is lower, often much lower, than the popular 30-year fixed rate mortgage. Whether interest rates are low or high, you want a rate that's lower than the average. An adjustable rate mortgage is a way to secure this, particularly if the interest rates have been low for a long time and look like they could remain low in the future.

If you know you're going to move for family or work reasons, the lower rates of an ARM can give you a financial boost.

2. You're Buying a House Soon

During the fixed-rate period of an ARM, you can save money over a fixed rate mortgage. ARM rates tend to be lower than the rates on a completely fixed-rate mortgage. If you know that you are going to move before the fixed-rate period is over, you can benefit from that lower fixed rate without experiencing an uncertainty in your mortgage rates. Those who like to buy and flip houses or who must move frequently due to work can benefit from the lower fixed rates of the ARM.

3. You're Refinancing

Are you planning to complete your mortgage payments soon? Do you have a lot of equity in your home? According to Forbes, you can take advantage of the fixed-rate mortgage period of your ARM to pay off your mortgage even faster. "Say you plan to pay off a $750,000 mortgage within seven years. Get a jumbo ARM set at 3.125% for the first seven years and you'll pay $18,000 in interest less than if you were to take a 15-year fixed-rate mortgage at 3.75%." If you have plans to finish off your mortgage, your ARM could be your ticket to an early completion.

4. You Have Financial Backup

An adjustable rate mortgage is just that: adjustable. This means that after a certain period, your mortgage rate could go up. You need to be able to accommodate for this in your budget. If you're buying a property at the very top of your price range and you don't have a lot of financial resources, you could run into problems.

However, the interest rate can go up, but it can also go down. If you and your financial advisors feel like interest rates will be stable or go down in the years of your adjustable rate mortgage, you could reap the benefits. If you know that you could ride out increased interest rates, you could benefit from the potentially lower rates of an ARM as well.

At Open For Homes, we're here to help you navigate the world of home purchases. Subscribe today to learn more about issues in the real estate industry, and search our properties so that you can find the right home for your family.